Bitdice

04 Sep 2017 • 0 CommentsBitDice Casino is currently in the middle of an ICO. The crowdsale started on August 15th and will end on September 15th.

This is an interesting ICO that is particularly investor-friendly compared to most recent ICOs. It is investor-friendly because there is already a lot of information about BitDice and the industry it operates in that is publicly available. Additionally, BitDice has been in existence since 2014 and is already operating profitably. The token is also somewhat unique in that it offers quarterly dividend payouts – 70% of BitDice profits will be paid out to token holders.

In this post, I will give an overview of what BitDice is and why it’s doing an ICO, talk about the investment pros and cons, and finish up with a financial model of BitDice with a video walkthrough of model details.

What is BitDice?

BitDice Casino is a cryptocurrency casino. You can check out their site here.

It only has a house edge of 1%, which is one of its main advantages. It was one of the earliest bitcoin gambling portals, and lays claim to several firsts in its industry, including the first to structure itself as a commercial entity, the first to implement WebSocket technology with a mobile-centric focus, and the first to adopt the Kelly investment model.

You can compare BitDice to other bitcoin gambling sites here. It’s currently the second largest.

Why is BitDice doing an ICO?

BitDice is doing an ICO to expand – it plans to move into fiat (or traditional) online gambling where users are less acquainted with the concept of provably fair games. It also plans to add more games to its platform, and to research blockchain-based solutions to online gambling.

Previously, BitDice had a debt-based investment program that was used for capitalizing the house bankroll – it’s worth noting that this debt based program had an ROI of 50%, which shows a great track record of being good to investors. However the program was restrictive and there wasn’t a lot of room for growth, and hence the ICO.

What is the market opportunity?

The online gambling industry is close to $50 billion in size and growing. Crypto gambling is currently only 5% of the market. BitDice plans to expand into fiat gambling, which is not only a much larger market, but its participants also seem to care less about the concept of “provably fair” games. BitDice can differentiate itself in this market by introducing this concept, and also increase profit margin with some games that have higher house edge.

What are the ICO details?

- token name: CSNO

- runs on: Ethereum blockchain using ERC223 standard

- total supply: 100 million, supply is locked

- quarterly payouts: 70% of BitDice profits

- besides payouts, CSNO tokens will also be one of the platform’s currencies and can be used to place bets, cash out, and reward players

- use of proceeds:

- 40% stored as the casino’s house bankroll to pay out winning bets and bonuses to the players

- 25% to fund capital expenditures related to platform development and business expansion, including development team compensation, developing new fair games, acquiring necessary licenses for fiat gambling, legal fees to bring business structure into full compliance with regulatory framework

- 10% promotion and marketing

- 25% kept as reserve

Investment Benefits

- BitDice is an established and profitable bitcoin casino

- Online gambling represents a large market opportunity

- BitDice has a good track record of being good to investors and delivering high ROI

Investment Risks All investments have risks, and one must always be aware of them. Here are some risks for BitDice:

- Online gambling is illegal in many parts of the world

- BitDice is unproven in fiat gambling and still needs to pass regulatory hurdles to be in full compliance with regulatory framework

- 70% payout may be changed

- Security may be compromised – this is always a possibility. According to BitDice’s whitepaper, they had faced “myriad attempts to hack its system”, but none of the attempts have ever succeeded.

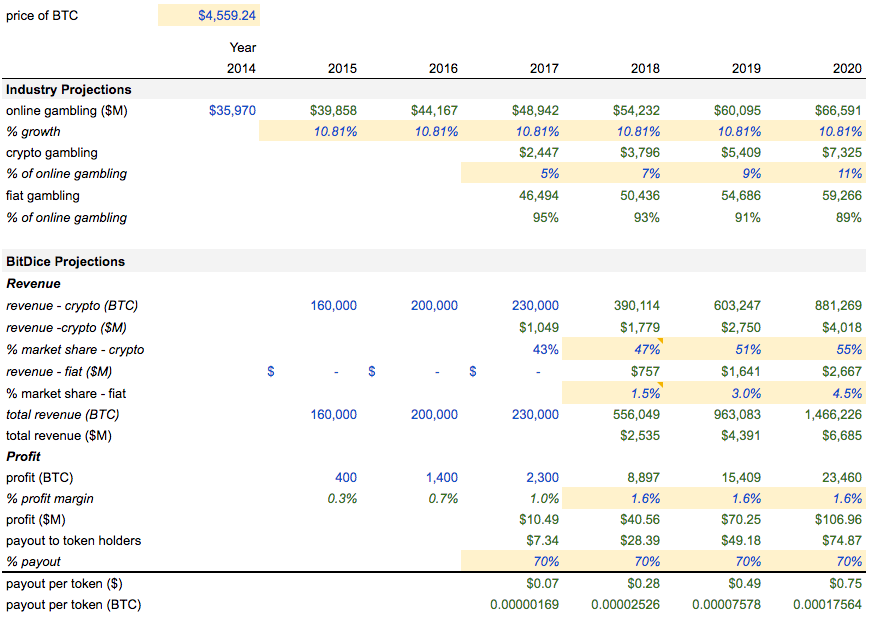

Financial Projections BitDice provides in its whitepaper three future scenarios for its financial projection – mediocre, optimistic, and extremely optimistic, with corresponding dividend payouts of $0.11/token, $0.33/token, and $0.51/token. The final price per token depends on total ICO proceeds but is $0.10 based on the minimum amount raised – so even in the mediocre case token holders can expect a +/- 100% dividend yield.

This is BitDice’s own financial projections in three cases:

The great thing about this ICO is that investors actually have enough information to build their own projections, so I created my own multi-year forecast below:

You can watch this video to see me walk through the projection in detail:

You can find my financial model here. You can feel free to comment on it in the sheet! Let me know what you think!

You can create your own projections too! Comment below to let me know what you think! And if you like what you see, you can partitipate in the ICO here.